3 Best Practices for Rewarding Employees

Written by: Tom Nash

(View Author Bio)

We all want to make sure we use our rewards budget as effectively as possible. Organisations want to ensure the budgets are producing the right behaviours in the most efficient way. But before we jump straight into rewards, we need to first get a handle of the best practice approaches in employee and sales programs.

Scroll Down

When it comes to maximising recognition, sales and reward programs, the most common questions I get asked are:

1. What is best in class?

2. I believe our program is great, but how do I truly know?

All effective recognition and reward programs come in different shapes and sizes depending on the long-term strategy and objectives. To be successful there is no doubt that all programs need to have one thing in common – it must engage your entire audience. That is how you engage, inspire and lift productivity across the entire organisation. A common scenario to see if this is true for your program:

What are you doing differently to engage and motivate your audience?

We have a generous base salary and individual compensation plan.

That's a great start, but lots of companies do and employees see this as business as usual.

We are announcing a new President’s Club award experience.

That’s awesome. Experiences are a powerful motivator but may only motivate the top 10 per cent. What about everyone else?

Silence.

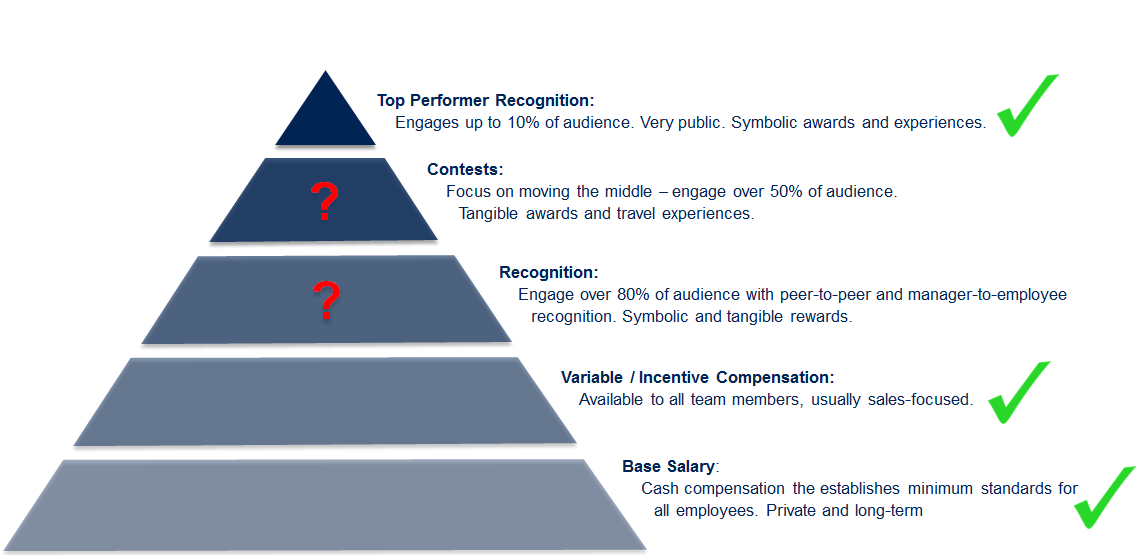

The best question to actually ask is what else are you doing to motivate, engage, recognise, and reward your new hires, and the middle performers that account for the majority of your audience? The truth is, most of the incremental lift comes from the lower 80 per cent, with only 35 – 40 per cent of sales uplift coming from the top 20.

Once you’ve understood what is best practice and are able to strategise your program that optimises engagement and performance, rewards can now come into the conversation. Here are three best practices that can help determine how much to give, when to give and when to give rewards.

Best practice for how much to give

An article titled, What are the 3 best ways to improve employee engagement, by HR Insider Australia outline that frequent recognition get the most out of employees. In fact, in our own research employee turnover is 4x less in organisations that frequently provide recognition with rewards.

The key point here is frequency and consistency in issuing rewards. To help with this, start with three reward tiers as a guide, for example:

- a LOW reward value for actions that affect the achiever’s immediate team

- a MIDDLE value for actions that affect a greater portion of the organisation

- a HIGH value for actions that affect a customer experience.

The tiered system can also be tired to how much an individual exceeded target. The important thing about this method is that you’ve created a way to evaluate achievers that is the same each time.

Best Practice for when to give

A big mistake Leaders make is rewarding employees for when they achieve a significant milestone. Well if we take that approach only, then around 10% at most would get recognised. If you’re trying to motivate people or change their behaviour, infrequent recognition will not achieve that.

Organisations should consider using their rewards budget to ensure low to middle performers, or the smaller achievements are recognised and rewarded. These are the individuals who will make the biggest changes in behaviour if they are engaged correctly. While your top performers deserve rewards, the other 60-80% of your team will deliver the highest return when given the opportunity to be rewarded. To engage the entire audience, they must feel they have a chance to be rewarded for their success, otherwise you risk having a disengaged audience.

Best Practice for what to give

As Insider HR Australia states, monetary reward programs have not been broadly successful… they can have undesirable side effects and unintended consequences like increased competition, reduced intrinsic motivation, and other bad behaviour.

Cash as a reward works – but only so much. Everyone wants more cash, everyone can use a gift card to buy groceries, fuel, etc. Unfortunately, these things really have no emotional component. Research tells us that we must trigger people’s emotions to motivate them. A BI WORLDWIDE analysis of data from one customer’s organisation examined the efficacy of different reward types:

- Debit cards loaded with cash

- Points that could be redeemed for a range of rewards

On average, employees earned more than $100/month on their debit cards and less than $100/month in points — eliminating the objection that points-based rewards might perform better simply because they’re worth more.

Difference in Spending Habits:

- More than 85% of employees saved their points for luxury and hedonic items like merchandise and experiences.

- They spent their debit cards regularly at vending machines, fast food restaurants, and gas stations, with nearly 85% of transactions under $30.

The difference in performance:

- Employees who earned points outperformed those who earned cash, experiencing on average a 43% unit increase over their baseline performance.

- Employees who earned cash experienced a 16% decrease in performance.

The bottom line is points inspire. Cash disappears into day-to-day necessities. Points inspire dreams – and the type of performance that moves organisations forward. Instead, use tangible rewards like award points and unique experiences to associate you with the award in that employee’s mind forever.